Investment Criteria

We exclusively target single tenant, long-term, triple-net lease commercial properties.

Unity has pre-committed capital sources readily available for deployment.

Typically, we look to do transactions with repeat counterparties and build long-term key vendor relationships.

We exclusively seek out single tenant, long-term triple-net lease commercial properties located across select U.S. states that we believe benefit from positive demographic shifts, are business friendly and which do not present significant climate change risks.

Our experienced investment team welcomes close cooperation with the buy and sell-side brokerage community and is able to undertake more sophisticated deal structuring, while maintaining certainty of execution.

What we're buying

Target asset classes include last-mile distribution and logisitics facilities (incl. cold storage), healthcare related facilities, standalone restaurants, fast food outlets and selected brand retail stores and outlets.

Property characteristics

| Land Title: | Fee simple only |

| Property Type: | Freestanding, commercial |

| Industry Type: | Last mile logistics, healthcare, restaurant, brand retail |

| Individual Deal Size Range: | US$ 5m – 10m |

| Portfolio Deal Size: | Up to US$ 30m |

| Location: | Preference for Texas, Arizona, Washington, Utah, Florida |

| Residual Value: | Properties with long-term future use scope/potential |

Lease characteristics

| Lease Type: | NNN long term |

| Occupancy: | Typically single tenant |

| Lease Term: | min. 8 years remaining term |

| Rent Escalations: | Fixed or market review rent increases required |

| Tenant Brands: | Internationally recognized brands, private or public |

| Credit Profiles: | All credit profiles |

Other

| Transaction Types: | Lease assumptions, forward commitments, 1031 exchanges, UPREIT |

| Financing: | All cash up to US$ 10m, assumption of existing mortgages |

Target Tenants

Investment Committee

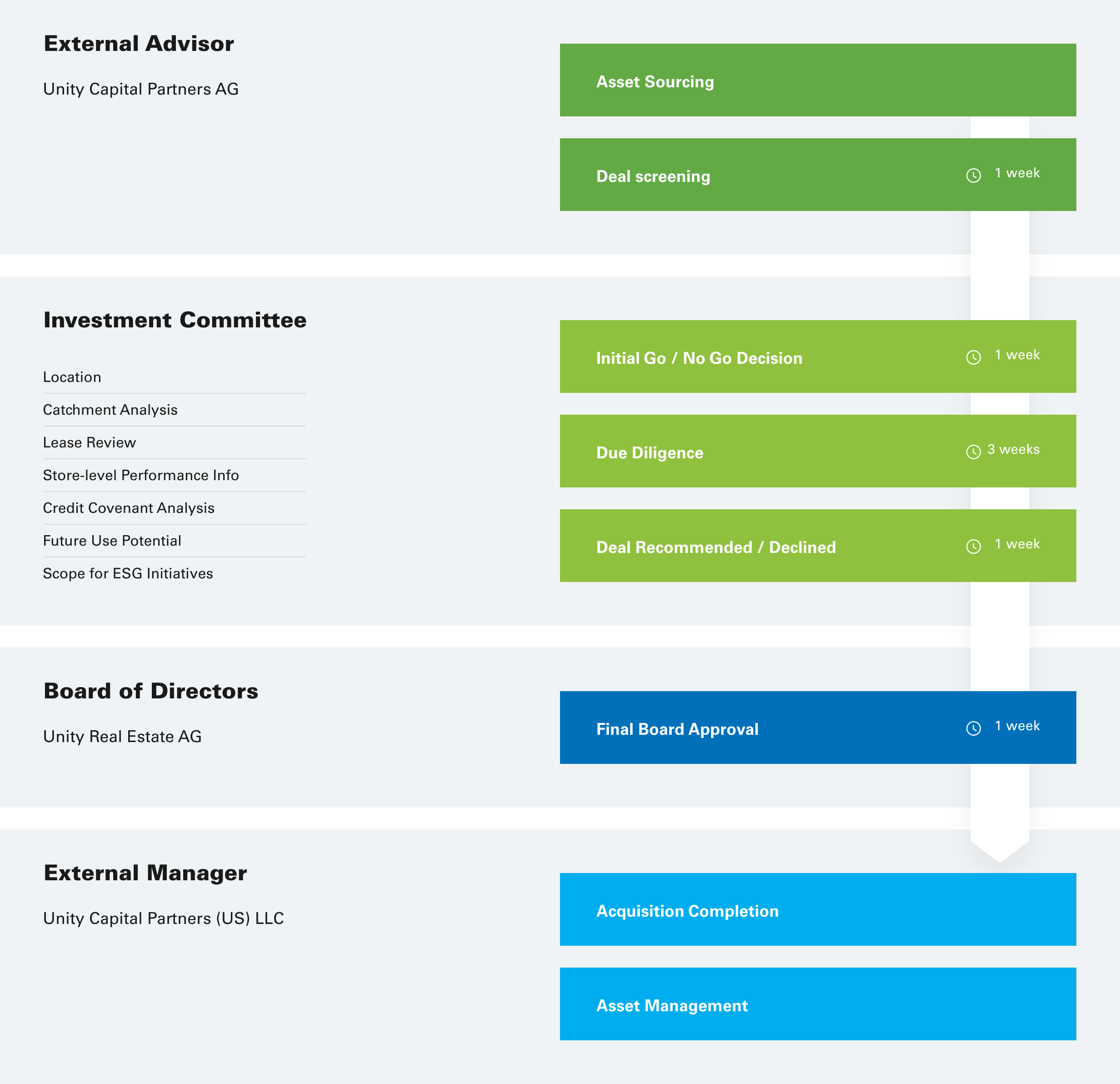

All prospective acquisitions are rigorously reviewed and challenged by our experienced investment committee in a two-phase approval process.

Once our acquisition personnel have identified and initially screened a potential acquisition which meets are strict investment criteria, it is then proposed to our experienced investment committee for further evaluation in order to be achieve an initial formal green light required to commence due diligence.

Thereafter upon successful completion of due diligence, all findings, including senior debt and contractual terms, are then comprehensively re-presented for final ratification and approval before being given a final green light enable a transaction to proceed.

Acquisition Process

While small, we are structured with institutional-grade underwriting and transaction processes in place.

Transacting with us

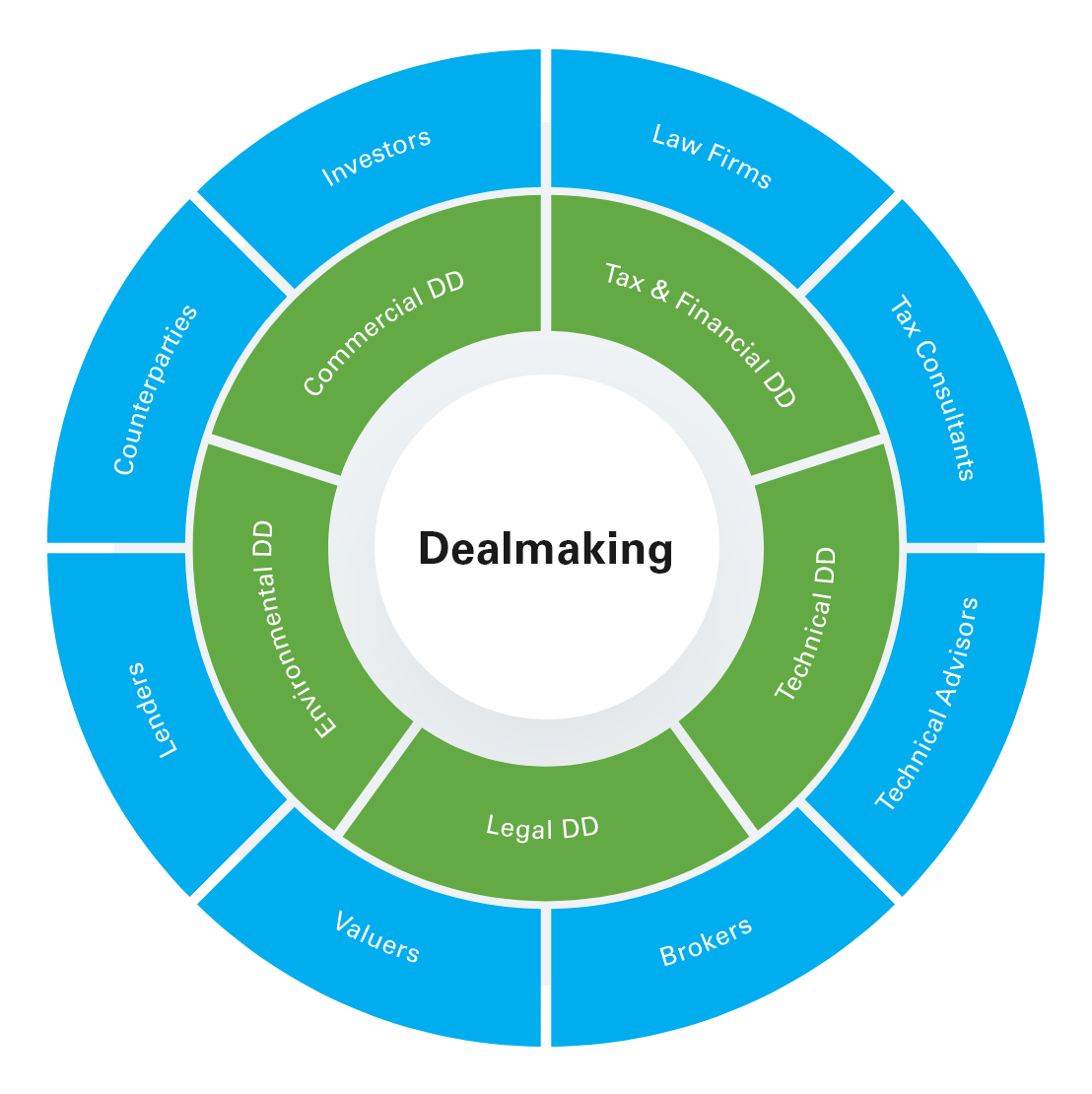

We view ourselves as thoughtful deal-makers who welcome cooperation with other experienced professionals to make deals happen.

While small, we nevertheless have significant transactional experience via the international track records of our founders.

In cooperating with the brokerage community, we always respect quality introductions and in special situations, are open to working with buy-side agents.

Our deal-making DNA

At Unity, deal-making is at our core.

With our principals having transacted and then successfully managed over USD 4bn in institutional grade commercial real estate across multiple geographies, we pride ourselves on our professionalism, and whilst a privately held company, also our institutional mindset and processes.

We are truly international with the ability to transact and operate cross-border and are people persons who seek out long-term, trusted relationships.

Acquisition Professionals

Please feel free to contact our acquisition professionals for an open discussion about any potential purchase opportunities.

Christopher Millen

CIO

By proposing a prospective acquisition to us, you hereby agree to our Website Terms of Use and in particular, the provisions relating to the submission of a property.